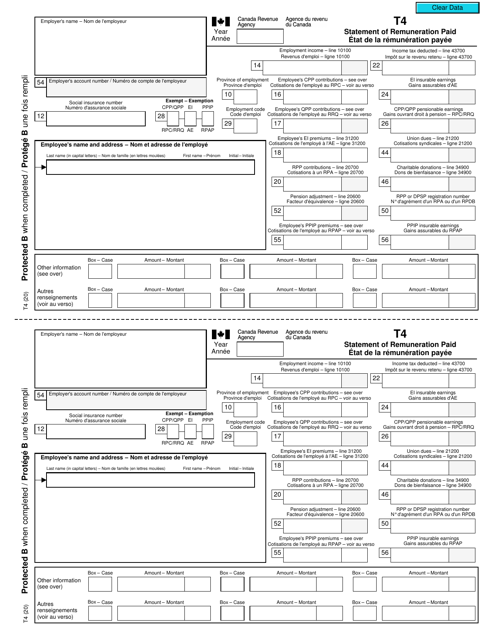

Once those thresholds are reached, no deductions are made for the remainder of the year. CPP and EI have maximum annual premiums.These deductions are mandatory on employment earnings, regardless of your citizenship.Your portion is deducted directly from your paycheque. Both employees and employers contribute to the Canada Pension Plan (CPP) and to Employment Insurance (EI) on employment earnings.If you adjust your basic claim amount, it is your responsibility to review it (current exemptions can be found on your pay statement) each year and submit new Withholding Elections if your circumstances change.Ĭanada Pension Plan and Employment Insurance deductions Increasing your taxes: The same method can be also be used to request an additional flat amount of tax to be deducted from each paycheque.From the Workday landing page, click the Worklet Pay and choose the Withholding Elections button under Actions. Reducing your taxes: In some instances, you can adjust your taxation rates by updating your Withholding Elections.UBC Payroll deducts taxes from your paycheques according to rules, legislation and computer formulas provided by the Canada Revenue Agency (CRA). CRA will provide copies of your T4 or T4A from previous years. Former Employees - Download T4sįormer UBC employees may access online T4s from the Canada Revenue Agency website and set up access to online services through My Service Canada Account. T4 and T4A tax slips for faculty and staff for the 2020 tax year are now available through Workday. They are identical to the printed form and are accepted by the Canada Revenue Agency (CRA) when filing your taxes. We issue tax slips online as PDFs that faculty, staff and student employees can download through Workday.

Get information about your taxes, including what is taxable, pension information and how to access your tax slips online.

0 kommentar(er)

0 kommentar(er)